RTD ALCOHOLIC BEVERAGES

What You Need To Know

RTDs aren’t the primary choice for most consumers. Expanding occasions and offering refreshing, low-sugar flavors can drive growth, especially among women and Baby Boomers.Consumers are drawn to RTDs by spirit type and flavor. Adjustments like higher ABV, seasonal flavors, and cocktail-inspired creations can expand consumption occasions.The RTD market is slowing, reflecting a natural correction that calls for adjusted expectations. Hard seltzers are facing the biggest challenges as their novelty fades and consumers explore other RTD options.

By Jennifer Rodriguez, T. Hasegawa

WHERE CAN SPACE BE CREATED

Since RTDs are rarely a primary drink choice, maximizing occasions is essential for sustaining momentum. Messaging must highlight versatility.

US: Alcohol Beverages Drank Most Often, 2024

DRINKING CASUALLY

32%

drink RTDs in casual social gatherings

RTD NEEDS TO CREATE A BROADER APPEAL

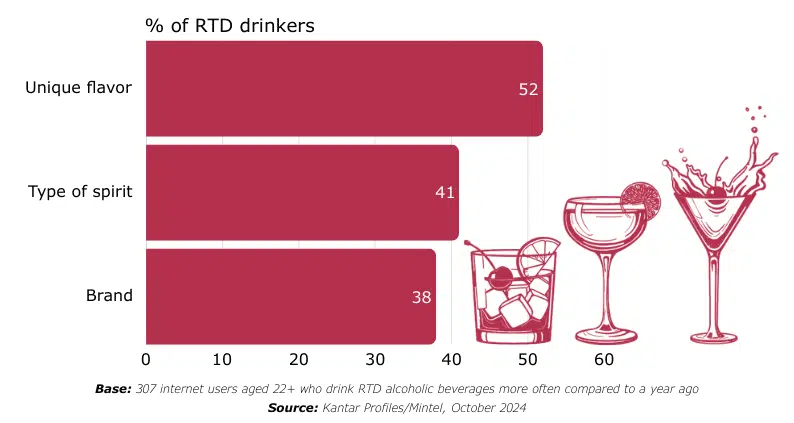

While good taste is essential for any food or drink, RTD consumers expectmore from brands. Unique flavors are key for over half of consumers,outranking spirit type, brand, and ABV. Brands emphasizing specificingredients, such as spirit type, can connect them to the creation ofdistinctive flavors.

To appeal to a broad audience, brands must address multiple purchasefactors, as no single attribute resonates with the majority, with mostfactors influencing less than 50% of consumers. Meeting diversepreferences is crucial for standing out in the competitive RTD market.

US: Reasons for Drinking RTDs More Often, 2024

ARE LIMITED TIME OFFERS CAUSING CONSUMER FATIGUE?

Many consumers seek variety in RTDs, but oversaturation is causingfatigue, with 47% feeling there are too many options and only 51% opento trying new products. Striking a balance is essential. Positioning varietyas a way to offer “something for everyone” can ease overwhelm, especiallywhen tied to special occasions, group activities, and celebrations,reinforcing RTDs as the perfect companion for entertaining.

Market correction is likely soon, with smaller brands facing challenges inmaintaining profitability amid intense competition. Many may be acquiredby larger companies aiming to diversify.

REVAMPED MESSAGING NEEDED TO ENGAGE GEN X & BABY BOOMERS

Winning older consumers requires tailored messaging. While convenience is key for RTDs, it’s not enough for Gen X or Baby Boomers, who don’t view their usual drinks as inconvenient.

Highlight casualization instead: spirit- or wine-based RTDs offer a similar experience without extra steps. For a more traditional feel, remind them RTDs can be poured into a glass, offering ease with a classic touch.

With lower ABVs and sugar, RTDs also appeal to older consumers seeking moderation over abstinence.

US: Types of RTDs Purchased By Generation

BALANCING TRIAL & TRUST: BRANDS MUST DELIVER TO SECURE REPEAT CUSTOMERS

Consumers are open to trying RTDs, but building brand loyalty remains a challenge. Offering diverse portfolios with various flavors, bases, and ABVs helps meet different preferences. The key is keeping RTDs easy to drink.

US: Reasons for Drinking RTDs More Often, 2024

EMERGING FLAVORS – FLAVORSCAPE AI

(Ranked 1-10)

1

Mimosas

2

Prickly Pear

3

Cucumber

4

Blueberry

5

Sour

6

Rosé

7

Ginger

8

Mandarin/Tangerine

9

Blood/Red Orange

10

Pear